Simplicity DEX

The underlying code for this project is found in https://github.com/Blockstream/simplicity-dex (other relevant repository links appear below).

Even though we call it a DEX, at its core there is no exchange of Token A for Token B in the traditional sense. The Simplicity DEX is a structured product marketplace that enables users to create and trade options contracts on-chain on the Liquid Network. We can also use similar techniques to create a means for advertising and performing direct, immediate exchange of pairs of assets in a decentralized way without an intermediary, but that functionality is planned for future development.

The protocol that we have built facilitates only the exchange of "Grantor Tokens" plus a premium in USD for LBTC tokens. Support for other variations will be added in the future.

The existing code uses Nostr to publicize the existence of contracts and allow a party to locate a counterparty. This document focuses mainly on the financial logic of the contract rather than the technical mechanisms for representating the contract on Nostr and Liquid.

Core definitions

Call Option: A financial contract that gives the holder the right, but not the obligation, to buy an underlying asset at a specified strike price before or at a specified expiration date.

Put Option: A financial contract that gives the holder the right, but not the obligation, to sell an underlying asset at a specified strike price before or at a specified expiration date.

Note: The underlying smart contract supports both Call and Put options, but the current CLI implementation only supports Call options.

Grantor Token: A tradable token received by the maker upon funding an options contract. The Grantor Token represents the right to claim assets at settlement - either the LBTC deposited during exercise (if the option is exercised) or the USDt collateral (if the option expires unexercised). In the current version of the protocol, the maker sells this token along with a premium in USD to a taker in exchange for LBTC.

Implementation

The protocol that we have implemented is a variation of a Call Option. The premium to the taker is paid during the exchange of LBTC and collateral tokens (i.e., Grantor Token).

Participants

Maker ("Option buyer"): The party that creates the options contract. Upon creation, the maker:

- Deposits USDt collateral into the Collateral Covenant

- Receives both an Option Token and a Grantor Token

- Keeps the Option Token (gives the right to exercise)

- Pays a premium in USD to incentivize the taker to buy the Grantor Token for LBTC.

Taker ("Option seller"): The party that purchases the Grantor Token and receives the premium in USD. The taker:

- Pays LBTC to acquire the Grantor Token from the maker

- Holds the Grantor Token, which entitles them to claim assets at settlement

Resources

The core contract of the Simplicity DEX is the Options contract: https://github.com/BlockstreamResearch/simplicity-contracts/blob/main/crates/contracts/src/finance/options/source_simf/options.simf

The concept for this contract was proposed in the following whitepaper: https://blockstream.com/assets/downloads/pdf/options-whitepaper.pdf

Link to the Simplicity DEX repository: https://github.com/Blockstream/simplicity-dex.

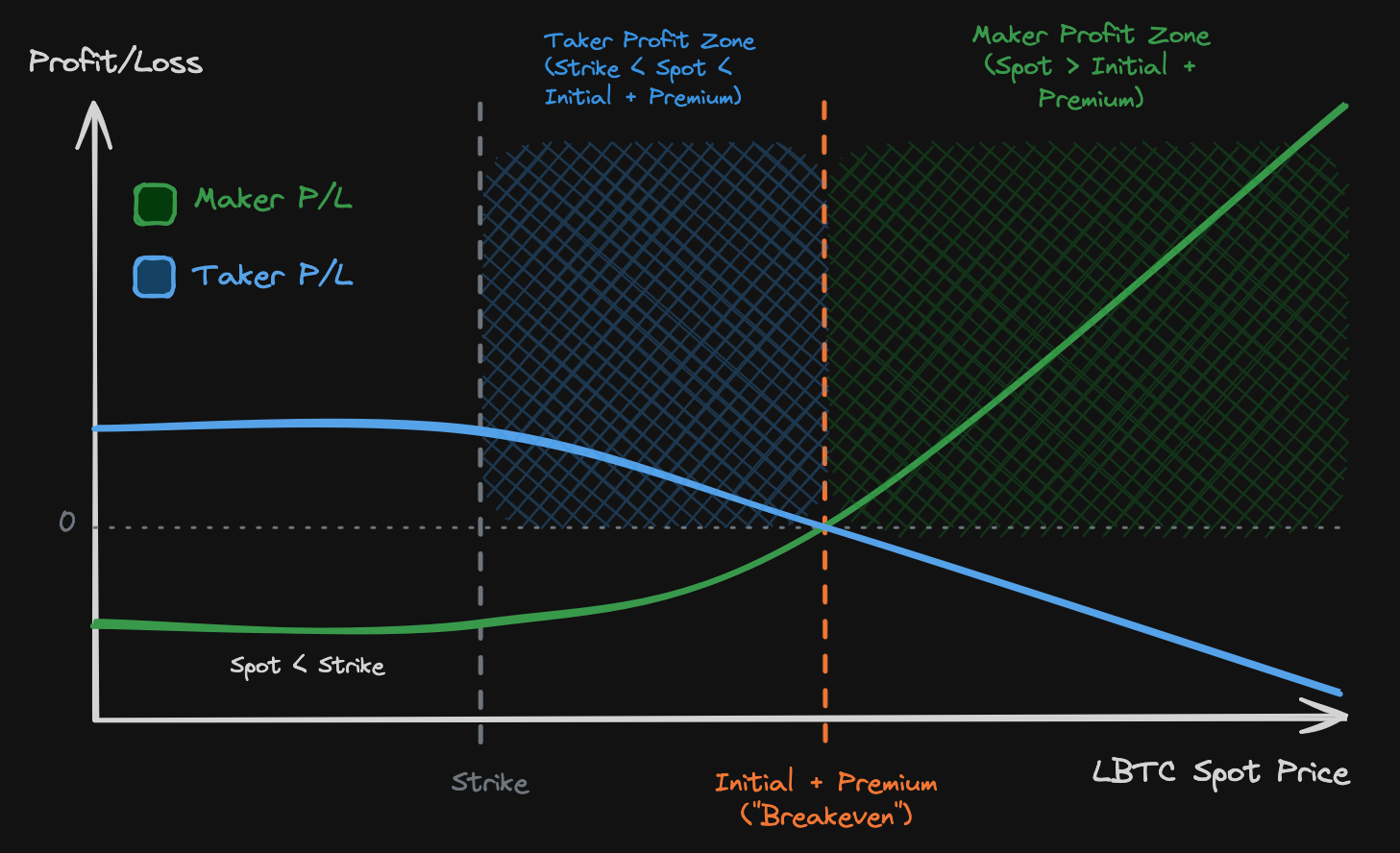

Financial Incentive

Maker Profit Condition: The maker profits when the value of the LBTC received (from selling the Grantor Token) exceeds the value of the USDt collateral deposited and the premium paid. This occurs when the LBTC price rises significantly above the strike price.

Taker Profit Condition: The taker profits when the premium they receive covers any potential losses, while still retaining a guaranteed claim on either LBTC (if the option is exercised) or the USDt collateral (if the option expires unexercised).

Option Offer Contract

The Option Offer contract enables depositing two assets (collateral + premium) into a single covenant. A counterparty can then swap their settlement asset for both deposited assets in a single atomic transaction, with amounts enforced by configurable ratios (collateral_per_contract and premium_per_collateral).

Detailed Step-by-Step Protocol Flow (Current implementation)

The maker selects locked-asset as USDt, and claim-asset as LBTC. The contract size is the collateral, e.g., 115,000 USDt. The strike price is $115,000 (LBTC/USDt). The term length is 30 days. The maker creates the "Options Creation" transaction which produces an Option Token Generator and a Grantor Token Generator held in a Generator Covenant.

The maker funds a single option using the "Option Funding" transaction, which requires depositing 115,000 USDt into the Collateral Covenant. The maker receives an Option Token and a Grantor Token from the Generator Covenant.

Note: at any time, the options contract can be canceled and the collateral retrieved by using both the Option Token and the Grantor Token together to unlock the collateral.

The maker deposits their newly minted Grantor Token along with premium (e.g., USDt) into the Option Offer contract. The taker pays LBTC (settlement asset) to the Option Offer contract and receives both the Grantor Token and the premium in a single atomic transaction. The maker keeps their Option Token.

Case A: LBTC ends below $115,000. Just prior to expiration, the maker uses their Option Token to exercise the Collateral Covenant. This requires depositing LBTC into a Settlement Covenant, which in turn unlocks the Collateral Covenant, whose 115,000 USDt funds the maker gets to keep. Afterwards, the taker can use their Grantor Token to retrieve the LBTC from the Settlement Covenant.

Case B: LBTC ends above $115,000 or the maker lacks adequate LBTC funds. The maker does nothing and their Option Token is useless. After the expiration date, the taker uses their Grantor Token to retrieve the 115,000 USDt from the Collateral Covenant.

Key Design Properties

This contract design avoids the need for a price oracle. Instead we simply rely on the Option Token holder's (i.e., the maker's) natural incentives to choose the appropriate outcome. The taker is required to get the lesser-valued asset of the two, after the expiration date. The choices the maker can make can only improve the taker's outcome. The maker could incorrectly exercise or not exercise their option, which will cause the taker to end up with the more-valuable asset, or the maker could incorrectly exercise their option early, allowing the taker to get access to their funds prior to the expiration date, or both.

It is the responsibility of the maker to optimize their handling of the options in order to extract the most value for themselves. Any other outcome can only benefit the taker.

By avoiding the price oracle, we also automatically handle the case where the maker defaults. In this case, the taker gets the USDt collateral, regardless of the LBTC price.

Our options design includes extra features that go beyond the basic specification. In particular, our Grantor and Option Tokens are real tradable assets, and both can be resold. This is particularly useful for the maker in the case that they are in default (i.e., does not have sufficient funds to exercise the option), but otherwise the option is in-the-money. In such a case, the maker can sell their Option Token to someone else who does have sufficient funds to exercise the option.

The design also allows for more than one pair of Grantor/Option Tokens to be generated. For example, the maker can generate 10 token pairs along with 10 Collateral Covenant UTXOs, each holding one tenth of the total collateral. This enables partially filling the order. These sets of Option Tokens and Grantor Tokens are fungible and tradeable. Unfilled orders (i.e., when not all the Grantor Tokens are sold) can be used, along with the same number of Option Tokens, to cancel unused Collateral Covenants and recover the funds immediately.

sequenceDiagram

participant Maker

participant Options as Options Contract

participant OptionOffer as Option Offer Contract

participant Taker

Note over Maker,Taker: Phase 1 & 2: Creation and Funding

Maker->>Options: Create Options Contract

Options-->>Maker: Generator Covenant created

Maker->>Options: Deposit USDt collateral

Options-->>Maker: Option Token + Grantor Token

Note over Maker,Taker: Phase 3: Token Sale via Option Offer

Maker->>OptionOffer: Deposit Grantor Token + Premium (USDt)

Taker->>OptionOffer: Pay LBTC (settlement)

OptionOffer-->>Taker: Grantor Token + Premium

Maker->>OptionOffer: Withdraw settlement (LBTC)

OptionOffer-->>Maker: Repay full amount of settlement (LBTC)

Note over Maker,Taker: Phase 4a: Settlement (spot < strike)

alt LBTC price below strike

Maker->>Options: Exercise with Option Token + LBTC

Options-->>Maker: Release USDt collateral

Taker->>Options: Claim with Grantor Token

Options-->>Taker: Release LBTC from Settlement

end

Note over Maker,Taker: Phase 4b: Settlement (spot >= strike)

alt LBTC price above strike (or maker default)

Note over Maker: Option expires worthless

Taker->>Options: Claim with Grantor Token

Options-->>Taker: Release USDt collateral

endAppendix A — Excalidraw file

profit-loss-diagram(2).excalidraw 28916

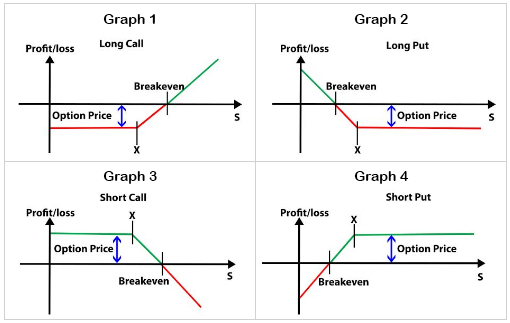

Appendix B: Mapping to Traditional Options Positions

The Options contract is flexible enough to create all four standard options positions depending on two parameters: the collateral type and which token the maker sells.

However, the current contract configuration forces the premium to be of the collateral type, not in USD.

The Two Determining Factors

Collateral type determines Call vs Put:

- USDt collateral → Call-like structure (the option is fundamentally about acquiring LBTC)

- LBTC collateral → Put-like structure (the option is fundamentally about acquiring USDt)

Which token is sold determines who holds the Long vs Short position:

- Sell Grantor Token (keep Option Token) → Maker holds the "long" position (has the right to exercise)

- Sell Option Token (keep Grantor Token) → Taker holds the "long" position (has the right to exercise)

The Four Configurations

| Configuration | Collateral | Token Sold | Maker's Position | Taker's Position |

|---|---|---|---|---|

| 1 | USDt | Grantor | Long Call | Short Call |

| 2 | USDt | Option | Short Call | Long Call |

| 3 | LBTC | Grantor | Long Put | Short Put |

| 4 | LBTC | Option | Short Put | Long Put |

Configuration 1 (USDt collateral, sell Grantor) is the current implementation described in this document. The maker profits when LBTC rises significantly (Long Call profile), while the taker has limited upside but collects the premium spread (Short Call profile).

Configuration 2 (USDt collateral, sell Option) flips the positions. The taker, now holding the Option Token, has the right to exercise and profits when LBTC falls (Long Call on USDt, effectively). The maker keeps the Grantor Token and has the Short Call profile.

Configuration 3 (LBTC collateral, sell Grantor) creates a Put-like structure. The maker deposits LBTC as collateral. The Option Token holder can deposit USDt to claim the LBTC. The maker (holding Option Token) profits when LBTC falls (Long Put profile).

Configuration 4 (LBTC collateral, sell Option) is the inverse of Configuration 3. The taker holds the Option Token and has the Long Put position, profiting when LBTC falls. The maker has the Short Put profile.

Practical Implications

This flexibility means market participants can use the same underlying contract to express different market views:

- Bullish on LBTC: Use Configuration 1 (maker) or Configuration 4 (taker)

- Bearish on LBTC: Use Configuration 3 (maker) or Configuration 2 (taker)

- Neutral/yield-seeking: Take the "short" side of any configuration to collect premium

The current CLI implementation supports Configuration 1, but the underlying smart contract is capable of supporting all four configurations.